In a surprising twist of ambition, Japan aims to reclaim its lost glory in semiconductor manufacturing, setting an audacious goal of producing cutting-edge 2nm chips by 2027. This initiative comes as eight of Japan's leading corporations, including renowned names like Toyota, Sony, SoftBank, and Canon, have united to form a consortium backed by a substantial government investment of $500 millionYet, the path to achieving this ambition seems daunting considering many factors, not the least of which is Japan’s current status in semiconductor technologyAt present, Japan’s most advanced manufacturing process stands at just 40nm, significantly trailing behind China's Semiconductor Manufacturing International Corporation (SMIC), which boasts a production process of 14nmThe venture raises the question: Can Japan truly leapfrog ahead into the realm of 2nm technology within such a short timeframe?

As we delve into this competitive landscape, the dynamics of East Asia's semiconductor industry emerge

Japan and China, both significant players, perceive this moment as a pivotal opportunity to outpace established leaders South Korea and the United StatesBut what are Japan's realistic prospects? Can they surmount the technological hurdles and regain their former stature in the global semiconductor hierarchy?

Furthermore, what challenges does South Korea face in its quest to refine semiconductor technology, and how might it posture itself amidst this fierce competition? This context is crucial to understanding the shifting alliances and rivalries shaping the industry’s future.

To comprehend these dynamics fully, it is essential to appreciate the semiconductor landscape currently dominated by ongoing conflicts among China, Japan, South Korea, and the United States, each vying for supremacy in a field where the stakes keep rising.

Starting with Japan’s current positioning in the global semiconductor value chain, the country plays a pivotal role upstream, commanding advantages in both raw materials and semiconductor manufacturing equipment

- Through Rate Cuts, Capital Flees: U.S. Stock Market Faces Volatility

- Nasdaq Hits 20,000: A New Benchmark?

- Silicon Valley Bank Collapse Sparks Financial Crisis Fears

- Polysilicon Futures Launch Upcoming

- U.S. Stock Futures Stabilize

A glance at the statistics reveals that Japan controls over 50% of the global market share in 14 out of 19 crucial semiconductor materialsThese materials are fundamental to the semiconductor manufacturing process, with Japan claiming more than 60% market share in front-end materials and 66% in back-end materials, reinforcing its dominance in this domain.

When discussing semiconductor manufacturing equipment, many industry watchers immediately think of photolithography machinesWhile these machines represent a critical aspect of the manufacturing process, they tell only part of the storyJapan excels in several other areas as well, holding a monopolistic grip on dicing machines and over 90% market share in probe equipment and coating machines.

Despite Japan's crucial role in the semiconductor industry, its presence often feels overshadowed by more broadly recognized players like mainland China, South Korea, and the U.S

This is partly by design; while Japan remains a powerhouse in providing essential raw materials, its lack of focus on developing advanced semiconductor manufacturing processes since the late 1980s has led to a diminished global presenceAfter a steep decline following the U.S.-Japan Semiconductor Agreement, Japan pivoted to focus on materials and equipment but has largely relied on international orders to sustain its business.

The global pandemic and escalating tensions in semiconductor competition among China, the U.S., Japan, and South Korea have placed immense pressure on JapanPreviously, during periods of strife with South Korea, Japan utilized its upper hand in material supplies to assert dominanceHowever, with the current backdrop of fierce international competition, orders for Japan's raw materials have become increasingly unstableThe perception that Japan, once a technological leader, is now seeking assistance in the domain of advanced chips has stirred a resolve to rejuvenate its semiconductor industry.

In light of these factors, the eight prominent semiconductor companies have united to create a joint venture aimed at revitalizing Japan's semiconductor prowess

To support this initiative, the Japanese government is committing 350 billion yen toward the establishment of a research center in collaboration with the United States, focusing specifically on advanced semiconductor technologyThis strategic move suggests an earnest effort to convert research into marketable products.

From Japan’s perspective, this collaborative model mirrors the successful industry-university-government partnerships of the 1970s which allowed Japan to overtake the U.Sin many areas of technologyHowever, in an age where Moore’s Law appears to be nearing its limits, the challenge of transitioning from 40nm to 2nm technology within just a few years seems a daunting and perhaps impractical leap.

The semiconductor community widely recognizes that the dividing line between mid-range and high-end chip manufacturing lies at the 28nm threshold

Progressing to smaller nodes exponentially increases production costs—an observation underscored by the history of TSMC, which first managed a 40nm process back in 2008. Hence, one could argue that Japan's technology currently mirrors TSMC's status from over a decade agoAchieving 3nm production in 2025 illustrates how far ahead TSMC has advanced, leaving Japan with the ambitious goal of catching up in less than five years—an effort that might be overly ambitious.

While support from American companies like Intel may provide some assistance, the critical question is whether the U.Sis inclined to share its advanced techniques fullyGiven the complex dynamics of global competition, it's unlikely that the U.Swould willingly create a formidable competitorThe collaboration seems aimed more at leveraging Japan’s strong materials and equipment capabilities to overcome 2nm production challenges while simultaneously managing competition with China.

However, Japan may misinterpret this collaboration as a substantial boost from the U.S

Although there may be some technological insights for Japan to glean, systemic support is unlikelyAn empowered Japan, thriving in semiconductors, runs counter to specific U.Sinterests, especially given the historical challenges the Japanese semiconductor industry posed to the American market.

That being said, while the leap from 40nm to 2nm is nothing short of Herculean, there remains a plausible path for Japan to advance from 40nm to 14nm, given its historical experience of fostering effective research partnershipsJapan's alignment with Western companies opens doors for the procurement of cutting-edge semiconductor equipment without facing significant political barriers, thereby enabling tangible progress.

Contrastingly, for China to achieve breakthroughs in its semiconductor endeavors, a clear strategy must be adopted.

Initial steps should focus on closing the gap in traditional silicon-based chips

Currently, SMIC's ability to produce 14nm chips is an achievement that should not be underestimatedSuch chips are seen as high-end components suitable for the majority of computers, servers, and automotive-grade applications.

However, significant challenges persist in achieving autonomy in high-end mobile devices, particularly concerning 5nm and 3nm processesWhile 14nm suffices for many commercial applications, for national security and cutting-edge technologies like supercomputing and quantum computing, more advanced chips are essentialFor instance, Nvidia's recent launch of the A800 chip, designed as a substitute for the restricted A100, underscores the need for advanced chips in high-tech applicationsTo propel forward in technological innovation, China must therefore pursue advancements beyond the current 14nm standard.

Second, China should consider leveraging the rise of the open-source RISC-V architecture, which can bypass the licensing issues faced with X86 and ARM designs due to geopolitical friction

Utilizing RISC-V avoids the complexities tied to American sanctions and offers a less technically demanding hardware platform compared to proprietary designs.

Despite its nascent stage, the RISC-V ecosystem is attracting significant attention, with numerous Chinese semiconductor companies banding together to develop this architectureIn contrast to major players like Intel and Samsung, China's commitment to RISC-V presents a compelling opportunity, as they are currently positioned in the developmental phaseShould RISC-V mature, it could potentially shift power in the semiconductor industry, providing an avenue for China to innovate beyond current limitations.

The third line of action should focus on bypassing critical dependencies related to EUV lithography machinesThe restrictions imposed by the U.Son ASML’s sale of these machines to China have drastically hindered SMIC’s ability to produce chips at the 5nm or lower nodes, reinforcing the urgency of independent solutions.

Several alternatives could be explored

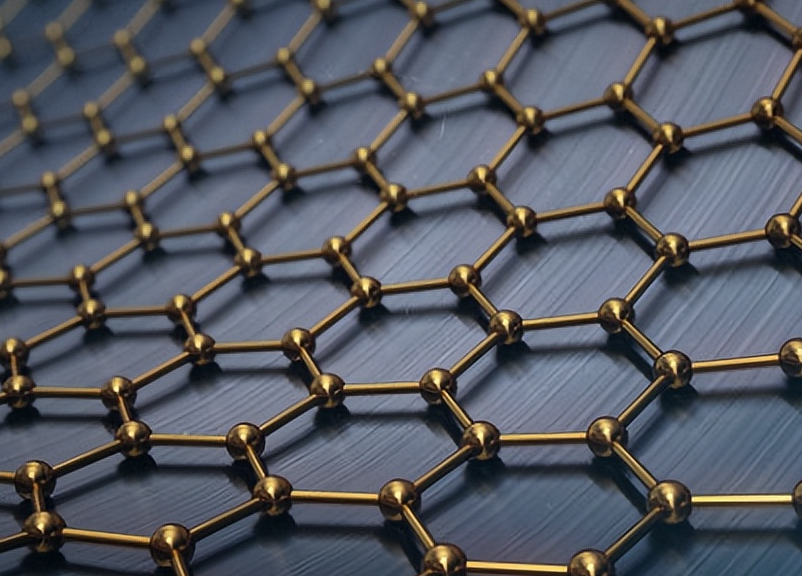

One potential avenue is through the development of advanced materials, such as graphene, which surpasses silicon in performance by over tenfoldPast research from IBM validated its feasibility, suggesting a possible leap for China in new material developmentBy concentrating efforts on graphene, China could lay the foundation for superior low-process silicon chips.

Another promising direction lies within photonic chips, recognized for their operational speed, which can dramatically exceed traditional chip performanceCharacteristically, photonic chips utilize significantly less energy than standard chips, offering a high-performance alternativeThe establishment of photonic chip production lines in China points to a potential strategic advantage in circumventing traditional semiconductor technologies.

Turning to South Korea, Samsung remains steadfast in its commitment to advancing semiconductor technology

Its approach, however, contrasts with Taiwan's TSMC, as Samsung primarily manufactures chips for in-house use, thereby creating internal dependencies.

Noteworthy is the recent introduction of a Korean semiconductor bill designed to consolidate efforts to bolster the industry's growthUnfortunately, political resistance has hindered its progress, illustrating a disheartening trend of political strife undermining the nation’s semiconductor aspirationsWith Japan and China ramping up their efforts, South Korea's inability to support its key players raises concerns about its future viability in this crucial sector.

Meanwhile, the United States retains its position as a semiconductor powerhouse, largely due to its unparalleled design capabilities and bargaining power within the industry.

The historical development of globalization has shaped today’s semiconductor supply chain landscape, compelling the U.S

to not only lead in technology but also to establish substantial production capabilities domesticallyThe move to have TSMC establish a factory in the U.Sdesigned for 5nm chips, despite significant cost disadvantages, reflects an overarching strategy to solidify U.Scontrol over semiconductor functionalities.

However, this strategy also raises questionsFor companies like Apple, operating in a profit-driven environment necessitates finding the most economical sourcesIf a substantial part of their supply still comes from foreign sources, U.Sinitiatives may lead to minimal benefits amidst rising costs.

Historically, the fall of Japanese semiconductor titan Toshiba during the 1980s serves as a sobering reminder of how quickly fortunes can shift, often driven by geopolitical rhetoric and corporate maneuvers.

In summary, navigating the intricate landscape of global semiconductor manufacturing presents unmistakable challenges for China, marked by obstacles across technological, material, and diplomatic fronts